The Buzz on Medicare Graham

The Buzz on Medicare Graham

Blog Article

The Of Medicare Graham

Table of ContentsThe smart Trick of Medicare Graham That Nobody is Talking AboutThe 6-Minute Rule for Medicare GrahamMedicare Graham Fundamentals ExplainedAll about Medicare GrahamUnknown Facts About Medicare Graham

Prior to we talk about what to ask, allow's chat about that to ask. For numerous, their Medicare journey begins straight with , the official internet site run by The Centers for Medicare and Medicaid Providers.

It covers Component A (medical facility insurance policy) and Part B (clinical insurance policy). These strategies function as an alternate to Initial Medicare while providing even more advantages.

Medicare Component D prepares help cover the cost of the prescription medicines you take at home, like your everyday medications. You can sign up in a separate Part D plan to include medication coverage to Original Medicare, a Medicare Price strategy or a few various other sorts of plans. For lots of, this is frequently the first question thought about when looking for a Medicare plan.

Not known Facts About Medicare Graham

To get the most cost-effective health and wellness care, you'll desire all the solutions you make use of to be covered by your Medicare strategy. Your strategy pays everything.

, as well as protection while you're taking a trip domestically. If you plan on taking a trip, make certain to ask your Medicare advisor about what is and isn't covered. Possibly you've been with your present physician for a while, and you want to keep seeing them.

Not known Details About Medicare Graham

Lots of people that make the switch to Medicare proceed seeing their routine physician, but for some, it's not that straightforward. If you're collaborating with a Medicare advisor, you can ask if your doctor will certainly be in network with your brand-new plan. If you're looking at plans independently, you might have to click some links and make some telephone calls.

For Medicare Benefit plans and Expense plans, you can call the insurance business to make sure the doctors you wish to see are covered by the plan you have an interest in. You can also examine the plan's internet site to see if they have an on the internet search device to discover a protected medical professional or center.

So, which Medicare plan should you select? That's the very best component you have options. And inevitably, the choice is up to you. Bear in mind, when getting going, it is very important to make sure you're as notified as feasible. Start with a listing of considerations, ensure you're asking the ideal inquiries and begin concentrating on what kind of plan will best serve you and your requirements.

Medicare Graham for Beginners

Are you regarding to turn 65 and end up being recently eligible for Medicare? The least pricey plan is not necessarily the ideal choice, and neither is the most costly plan.

Also if you are 65 and still functioning, it's a great idea to assess your choices. People receiving Social Protection benefits when transforming 65 will be instantly registered in Medicare Parts A and B. Based on your work circumstance and health and wellness treatment options, you might need to take into consideration enrolling in Medicare.

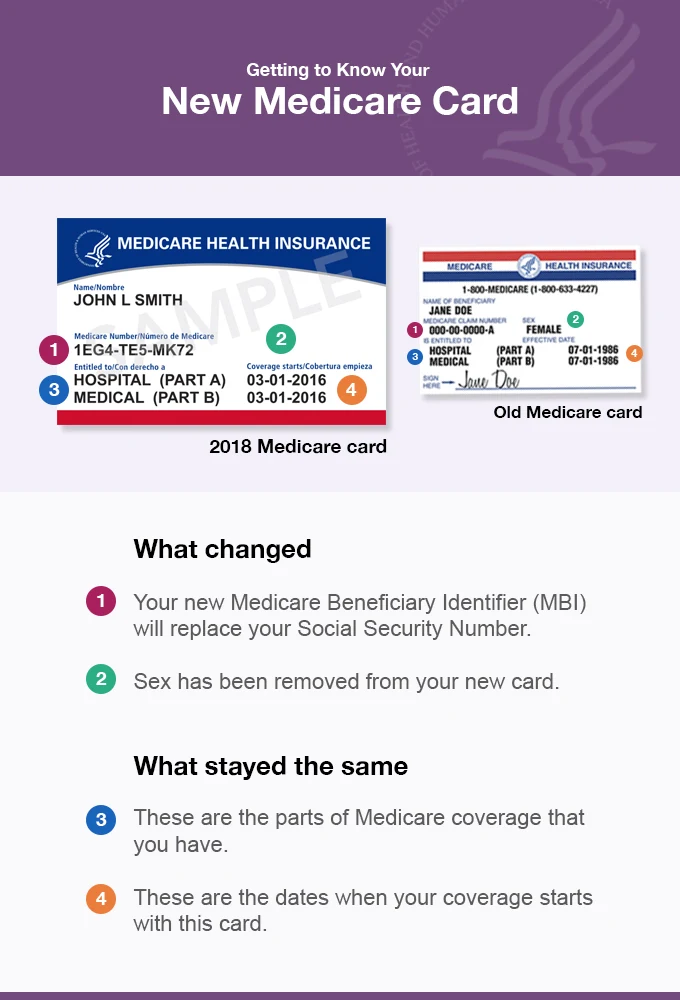

Original Medicare has 2 parts: Component A covers hospitalization and Component B covers medical expenses.

Not known Facts About Medicare Graham

There is typically a costs for Component C plans on top of the Component B costs, although some Medicare Benefit intends deal zero-premium strategies. Medicare Lake Worth Beach. Testimonial the insurance coverage information, prices, and any kind of additional advantages provided by each plan you're thinking about. If you register in original Medicare (Parts A and B), your costs and insurance coverage will coincide as other individuals that have Medicare

(https://www.sooperarticles.com/authors/793196/billy-taylors.html)This is a set amount you may need to pay as your share of the cost for care. A copayment is a fixed amount, like $30. This is one of the most a Medicare Benefit participant will have to pay out-of-pocket this for covered solutions every year. The amount differs by strategy, but as soon as you get to that limitation, you'll pay absolutely nothing for covered Part A and Component B solutions for the rest of the year.

Report this page